INTRODUCTION TO CERTIFICATE IN CLIMATE RISK

The Certificate in Climate Risk (CICR) is developed by the Chartered Body Alliance, comprising the Chartered Banker Institute (CBI), UK; the Chartered Insurance Institute (CII), and the Chartered Institute for Securities & Investment (CISI). It encompasses a wide range of developments in climate change and its impacts, the rapidly evolving policy and regulatory landscape relating to climate risks, and the substantial progress in finance sector practice in addressing climate and broader sustainability risks. The CICR programme aims to develop the learner’s professional knowledge, understanding and skills relating to climate change, climate risk and sustainable finance, with a view to supporting customers, clients, colleagues, and communities with the transition to a sustainable, low-carbon world.

TARGET AUDIENCE

With broad financial services sector coverage, the CICR programme is ideal for all financial services professionals, including bankers, insurers, investment managers, central bankers and regulators, risk managers, analysts and consultants, who have an understanding of risk management principles and wish to develop and demonstrate their knowledge and expertise of climate risk.

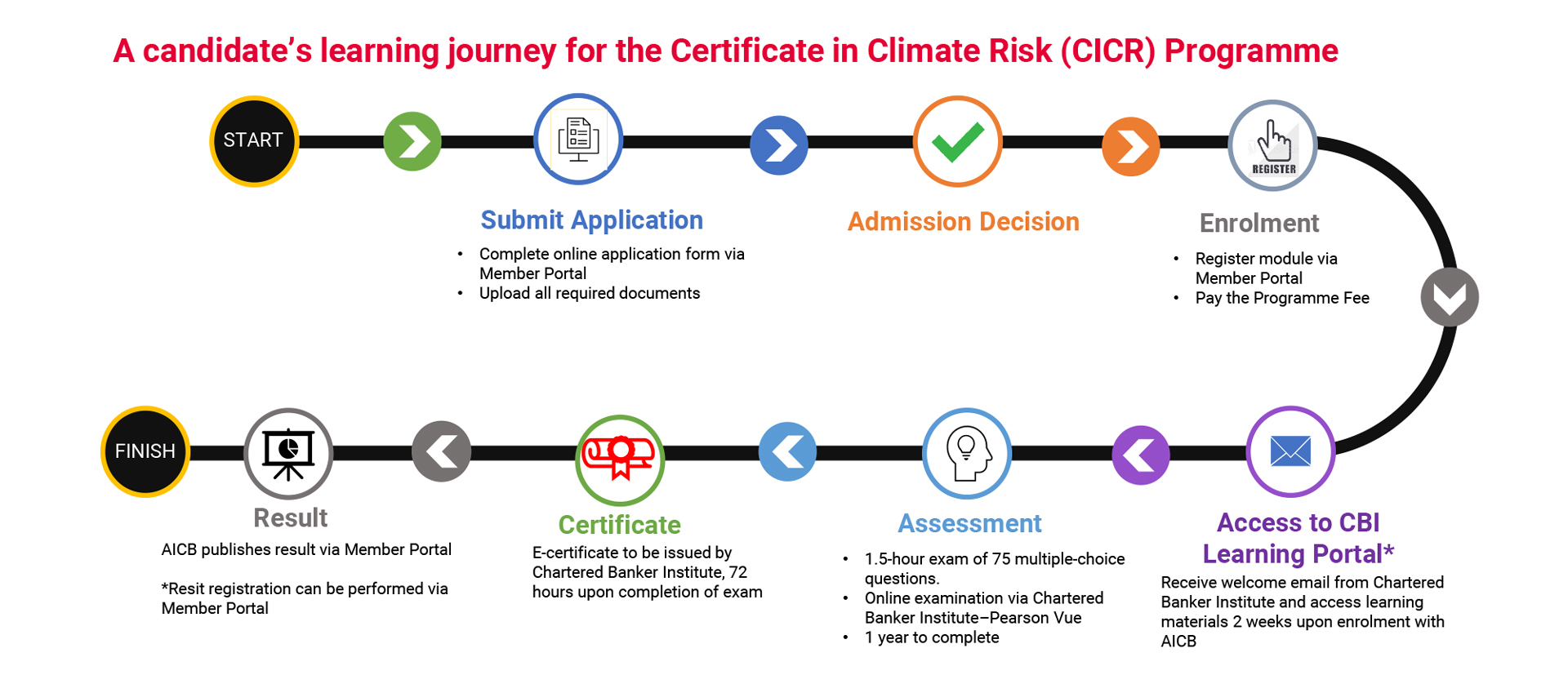

ENTRY REQUIREMENTS AND ENROLMENT

For more details on the entry requirements and documentation required for enrolment, click here.

MEMBERSHIP AND PROFESSIONAL DESIGNATION

Members who have successfully completed the Certificate in Climate Risk will maintain the Affiliate membership designation and can proceed to take any of the programmes in Level 2 of the Chartered Banker qualification.

Upon completion, members will be entitled to use the designation Cert CRP (Certified Climate Risk Professional).

MODULES

For more information on the aim, learning outcomes, syllabus outline, and assessment structure and format of the Certificate in Climate Risk modules, click here.

ASSESSMENT

Click here for more information on the assessment format.

EXAM

Click here for more information on examinations.