A. Overview of AICB’s New Professional Education and Membership Framework

Cognisant that our suite of professional banking qualifications should remain relevant and reflect current trends and developments in the ever-evolving banking environment, the Asian Institute of Chartered Bankers (AICB) embarked on an effort to streamline our qualifications and raise our banking education standards to build our members’ competence and prepare them for the future of banking. One of the key initiatives aligned to this goal is the Qualification Quality Review (QQR) initiative by AICB, which aims to:

This QQR initiative is an enterprise curriculum review initiative in collaboration with the Chartered Banker Institute (CBI), UK, which aims to ensure that AICB maintains a high quality and relevant education framework to build progressive pathways for professional membership at international standards, further supporting our members’ professional journey and career advancement.

B. The New Chartered Banker (CB) Curriculum and Membership Framework

The QQR initiative culminates in the establishment of the new professional education framework — the Chartered Banker (CB) Curriculum and Membership Framework (CB Framework) — whereby qualifications in the current curriculum are streamlined via assessment compaction and the discontinuation of selected modules to help ease candidates into the new CB curriculum pathway with minimal disruption to their learning journeys.

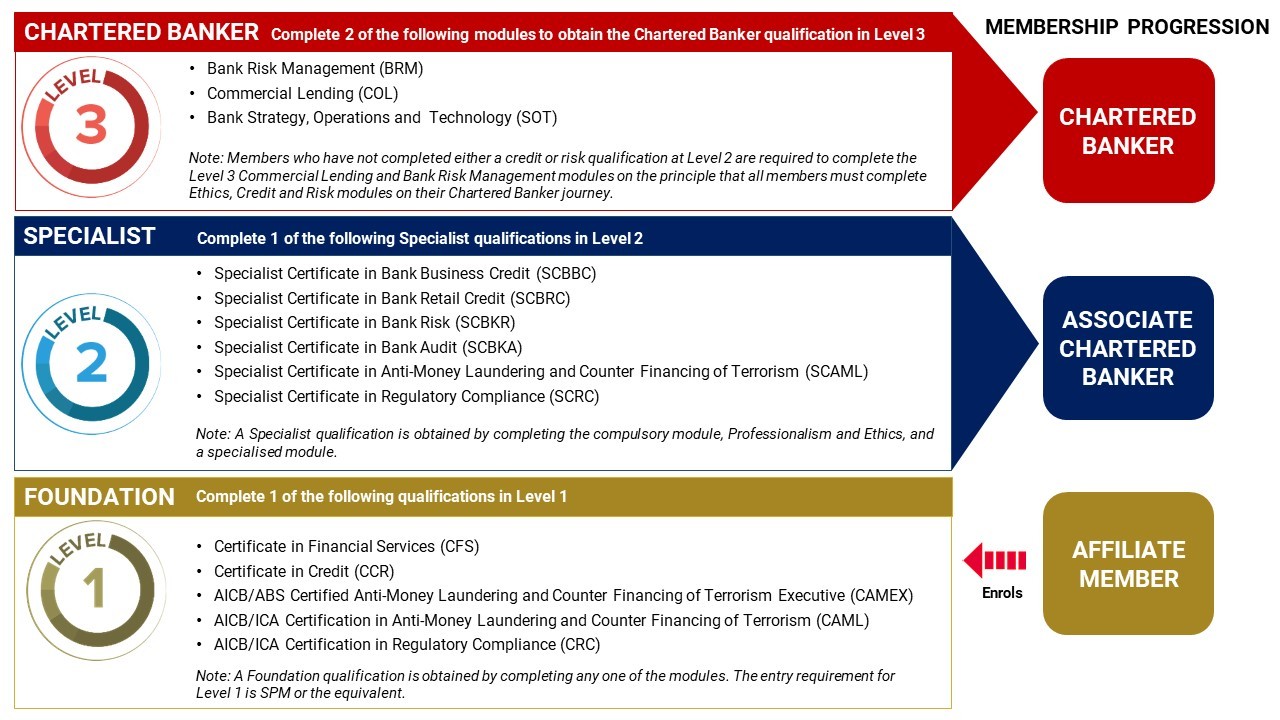

All qualifications will now be part of the new CB Framework that comprises the 3 progression levels below (Diagram 1), and it will be introduced in June 2022.

Diagram 1: The New Chartered Banker (CB) Curriculum and Membership Framework

The new CB Framework also comes with a new assessment structure, as follows (Table 1):

LEVEL | MODULE | TYPE OF ASSESSMENT | |||

|---|---|---|---|---|---|

EXAM | WRITTEN EXAM | ASSIGNMENT | |||

LEVEL 1 | Certificate in Financial Services (CFS) | ✓ | – | – | |

| Certificate in Credit (CCR) | |||||

| Certified Anti-Money Laundering & Counter Financing of Terrorism Executive (CAMEX) | |||||

| Certification in Anti-Money Laundering and Counter Financing of Terrorism (CAML) | – | ✓ | ✓ | ||

| Certification in Regulatory Compliance (CRC) | – | ✓ | ✓ | ||

LEVEL 2 | Professionalism and Ethics (PET) | – | ✓ | – | |

| Bank Business Credit (BBC) | ✓ | – | – | ||

| Bank Retail Credit (BRC) | |||||

| Bank Risk (BKR) | |||||

| Bank Audit (BKA) | ✓ | – | – | ||

| Certified Anti-Money Laundering & Counter Financing of Terrorism Compliance Officer (CAMCO) | ✓ | – | ✓ | ||

| Advanced Certification in Anti-Money Laundering and Counter Financing of Terrorism (ACAML) | – | ✓ | ✓ | ||

| Advanced Certification in Regulatory Compliance (ACRC) | – | ✓ | ✓ | ||

LEVEL 3 | Commercial Lending (COL) | – | – | ✓ | |

| Bank Risk Management (BRM) | |||||

| Bank Strategy, Operations and Technology (SOT) | |||||

Table 1: Examination Structure of the New Chartered Banker (CB)

Curriculum and Membership Framework

C. Key Differences and Benefits of the New Chartered Banker (CB) Curriculum and Membership Framework

Similar to the current CB Framework, the new CB Framework is also a 3-level model, but with changes to the qualifications and modules offered at each level. The main difference between the old and new frameworks is that the specialised qualifications are now part of the CB Framework.

The new CB Framework will feature updated content with a range of modules critical to banking and is designed to ensure that our members are able to face the challenges and seize the opportunities of banking in the future.

Key Benefits at a Glance

The benefits of each level are as follows:

Foundation: Level 1

The Foundation level (Level 1) offers a range of modules that allow members to gain a broad understanding of Malaysian banking through the Certificate in Financial Services (CFS), which covers key elements of:

This module is suited to ambitious bankers looking to consolidate or develop their knowledge base. Level 1 also offers members the opportunity to study specialist modules in credit, combatting money-laundering and regulatory compliance. Members are required to select 1 module to obtain a qualification and complete Level 1.

Specialist: Level 2

The Specialist level (Level 2) offers members a technical and applied perspective of key banking topics such as:

Members are required to select 1 of the specialised modules and take the compulsory module, Professionalism and Ethics. The approach to Professionalism and Ethics focuses on the banking industry and is highly applied, challenging members to combine their work experience and technical knowledge with a deep understanding of ethical concepts and how they can be employed in the workplace.

Upon successful completion of Level 2, members will achieve the Associate Chartered Banker status.

Chartered Banker: Level 3

The Chartered Banker level (Level 3) represents the pinnacle of study in the CB Framework and is developed and awarded with the Chartered Banker Institute, UK. It is a graduate-level qualification that builds on members’ existing qualifications and experience, further developing their knowledge, critical thinking skills and strategic viewpoint.

In conjunction with the wider AICB framework, Level 3 is designed to support individuals who aspire towards leadership roles by providing a substantial and varied knowledge base, as well as the ability to consider and respond to new developments. It features substantial coverage of technology, leadership and change, in addition to core banking knowledge.

There are 3 modules at this level and each module offers different opportunities for individuals to develop their knowledge and skills in a range of subjects that are critical to modern banking.

Members are assessed via challenging assignments drawn from their work experience and learning insights to ensure a close fit between professional qualifications and business needs.

Members who have completed Level 3 will attain the Chartered Banker status, the gold standard for professionals in the banking sector. Chartered Bankers are recognised as highly qualified, professionals with detailed knowledge of the modern banking sector and its ethical and professional requirements.

The CB Framework offers a flexible study and assessment schedule, allowing members to study at their own pace and be able to attend to their other commitments. Members will also have access to learning materials and a mock examination for each module via an online learning platform.

Examinations/assessments are also delivered online, and bookings can be made at the convenience of members. Members may sit for their examinations at a test centre or remotely, subject to them meeting compatibility requirements and rules for taking online examinations remotely.

D. Module Phasing Out Plans

With the commencement of the new Chartered Banker curriculum in June 2022, most of the current qualifications will be discontinued in phases.

The following qualifications will be phased out as follows (Table 2):

Qualification | Application Submission Closing Date | Last Examination Sitting for Existing Candidates |

|---|---|---|

| Executive Banker (EB) | 30 November 2020 | November 2021 |

| Professional Banker (PB) | 31 May 2022 | December 2023 |

| Chartered Banker (current syllabus and format) | 31 January 2022 | July 2023 |

| 31 May 2022 | June 2023 |

Table 2: Phasing Out of Current Qualifications

Members are encouraged to complete their current qualifications during the transition period to progress to the next level of study in the new curriculum. With online examinations available every month, there will be ample opportunity for members enrolled in the current framework to complete their modules. Members are encouraged to complete their remaining modules before the transition deadline, failing which members are required to take the module of the equivalent level, e.g., Executive Banker candidates are required to take a Level 1 module, Professional Banker candidates are required to take the Level 2 compulsory module and choose one specialist module.

E. Transition Plan

We hope the information above helps to give you a better understanding of the CB Framework and what it entails for AICB’s members. We will be sharing further details on the transition pathway in August 2021.

F. Frequently Asked Questions (FAQs)

We have prepared a set of Frequently Asked Questions (FAQs) in anticipation of the questions that you may have on the new CB Framework. Kindly download the FAQs here.

We understand that you may have many questions on these new developments and in the coming months, the Institute will organise briefing sessions for members to familiarise themselves with the new CB Framework.

In the meantime, if you have any enquiries on the new CB Framework, kindly send an email to our Member Services team at [email protected]

Thank you.

We will get back to you shortly.

There's an error submitting your query. Please try again later.